Understanding Bitcoin Options

Published

Bitcoin is a volatile asset that has grown exponentially ever since its inception in 2009. Being essentially unregulated, it has found immense popularity with people mostly unprepared to deal with both its 2017’s quick rise and 2018’s disastrous fall.

This post is meant to explain what options are and how they can be used to protect your value and lock-in profits without giving up on a possible upside.

What is an option?

An option is a financial contract that enables you to make a choice regarding an asset, hence giving you an “option”. Options come in two different forms: call and put, which are related respectively to buying and selling.

The idea behind an option is really simple and better understood through an example:

Let’s go the past for a bit, in December 2017 to be precise.

Bitcoin is all the rage and trading at 17,000$ due to a sharp upward movement.

You believe Bitcoin is here to stay, that it has a way to go but you wish you could lock in some profits in case things go wrong.

To do so, you go to a reliable exchange listing Bitcoin options (such as the infamous Deribit exchange) and buy one put with a strike price of 17,500$ and an expiration date of June 2018.

In layman terms, this means we have just bought the possibility to sell one full bitcoin at a 17,500$ value in June 2018. When the day comes, we can choose to exercise or not this put.

Looking at current options prices and Bitcoin historical values, buying such a put would have cost around a 1,000$ and protecting us from a loss of 11,000$.

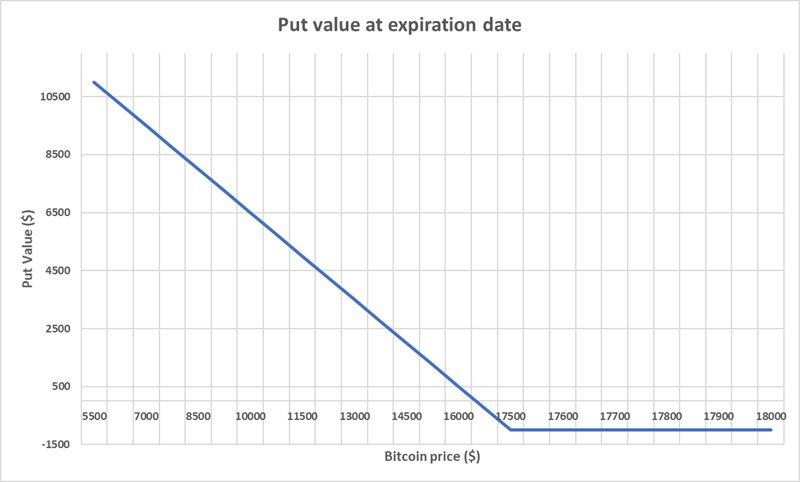

Here is a simple payout graph for this option.

As we can see, the only loss that a trader buying such a put can suffer is the price of the option. Any move of the price below 16,000$ ends up in a profit for the option holder.

How to choose an option

As a trader looking to protect his portfolio, you will mostly be buying options.

Why? Because only the buying side gets to choose. The selling side takes all the risk for itself by promising to buy/sell the asset at the given strike price.

Choosing the Option

Option type

As said above, there are two types of options: calls and puts.

We’ve seen already the use of a put as a way to lock in a sell price and profits.

Calls are the opposite of puts: they enable you to have the choice to buy the asset at a given price. Just as puts are used to ensure access to an interesting sell price, calls give the opportunity to “buy the dip” without risking all your capital.

Simply said: calls go with an upward movement, puts go with a downward movement.

Strike price and expiration

The strike price is the price at which the option will be locked. In our example, we locked a bitcoin price at 17,500$ because it seemed (rightfully so) like a good price.

If we were confident in a continued upward movement, we could have chosen to instead buy calls at 17,500$, hence locking a future buy price lower than the market price.

The expiration date is quite simply the lifetime of the option. A normal option can only be exercised then although it can be freely traded until then.

Both of these variables have an impact on the option’s price. The value of an option is a reflection of both the difference in price between the strike and the asset as well as the volatility of the asset itself (Which makes sense since the aim of an option is to protect from volatility).

Since a longer period of time means more time for the volatility to affect the asset price, options with an expiration date that is further in the future are more expensive.

As a rule of thumb, a call with a strike price under the asset price will be valued at :

Same for a put:

Keep in mind that these equations are voluntarily simplified for easier and quick math.

Complete books have been written on the subject of option valuation. A personal favorite of mine is Options, Future and Other Derivatives by John C. Hull. It is a massive book, but I’ve never needed anything else and it has become my personal reference.

Conclusion

Options are an inexpensive way to both limit and increase exposure to an asset. Even simply buying one option can as we’ve seen protect you from a adverse market movement without having to put in too much capital.

The low capital needed to put in trade also means that options can be used for completely speculative trades, somewhat likening leverage.

Multiple options can also be combined to deal efficiently with the market’s expected evolution, check out Collar options or Bull / Bear put spread for some ideas.